It may not be free money per say, but companies who need an injection of funds to improve their cash flow in this recession may check with the government to see if there are any unclaimed monies due to them.

It has been reported by the Ministry of Finance that the amount of unclaimed money held by the government amounted to approximately S$274 million, with 80 per cent belonging to individuals. That still leaves about S$42.6 million due to businesses.

Unclaimed money refers to money held by various ministries, statutory boards, and organs of state because the owners of the money have not been contactable. For individuals, the vast majority of unclaimed money appears to be from deceased estates left unclaimed, or assets which are bona vacantia. This refers to the assets in the estates of people who have died intestate and without any surviving entitled next-of-kin, requiring someone to make an equitable or moral claim to the estate (by producing sufficient supporting evidence).

What unclaimed money do corporate entities generally have?

For businesses, unclaimed money usually come from:

Money paid to creditors of defunct companies under the Insolvency and Public Trustee's Office (IPTO),

Corporate tax refunds from the Inland Revenue Authority of Singapore (IRAS),

Levy bonds with the Ministry of Manpower (MOM),

Vehicle-related transactions under the Land Transport Authority (LTA), and

Security deposits under the Info-communications Media Development Authority (IMDA).

These constitute roughly S$42.1 million out of the S$42.6 million unclaimed for businesses.

An example of these would be a company, having applied for a levy waiver for a foreign worker after paying a levy bill, being granted a refund but the company owner became subsequently uncontactable.

The single largest sum of money unclaimed by a business is a corporate tax refund of about S$190,000. Meanwhile, the oldest sum of unclaimed money belonging to a business is S$100, collected from the business entity in 1997.

How to check if your company has any unclaimed money?

The government has published a register that records all unclaimed money belonging to both individuals and businesses. Simply go to the website and make a search using the name of the company to see if there is any unclaimed money, or outstanding refund.

If you do not fully recall the name of the company, you can make use of the advanced search function to filter out specific categories and peruse the individual entries within them. Be warned though, some categories contain tens of thousands of entries.

How to make a claim

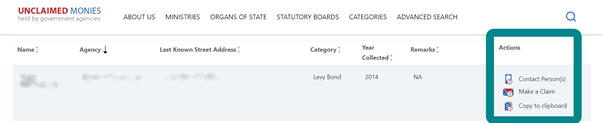

If the search successfully shows any entries, you can just click on ‘Make a Claim’, under the ‘Actions’ column on the right, to send an email that is already pre-filled with the relevant information to the corresponding government authority, who will be in touch to go through the process of facilitating the refund.

Alternatively, you may wish to manually send an email yourself. Click on “copy to clipboard” to copy the content of the unclaimed monies record, and paste it in your email, with the subject titled “please process my claim”. The email recipient is also indicated within the record itself.

Do note that these refunds are made without interest.

Unclaimed money is transferred to the government's consolidated fund after six years, but there is no expiry date to make a claim; as long as a claim is valid, it will continue to be repaid - regardless of when the claims date back to.

Read also: Expired or Expiring Singapore SME Government Grants from 2020 (Will Budget 2021 Provide New Support?)

Read also: The Best Business Banking Accounts in Singapore

-------------------------------------------------------------------------------------------------------

Got a Question?

WhatsApp Us, Our Friendly Team will get back to you asap :)

Share with us your thoughts by leaving a comment below!

Stay updated with the latest business news and help one another become Smarter Towkays. Subscribe to our Newsletter now!

Real CBS Makeovers: 3 Case Studies of SME Owners Who Turned Bad Credit Around

Real CBS Makeovers: 3 Case Studies of SME Owners Who Turned Bad Credit Around Ask SmartLend: Why Did My SME Loan Get Rejected?

Ask SmartLend: Why Did My SME Loan Get Rejected? Introducing SmartLend Concierge: A Helping Hand for SME Loans

Introducing SmartLend Concierge: A Helping Hand for SME Loans Legal Ways to Lighten Your Company’s Tax Burden in Singapore

Legal Ways to Lighten Your Company’s Tax Burden in Singapore A Wake-Up Call on Director Duties: The Envy Saga and Other Cautionary Tales in Singapore

A Wake-Up Call on Director Duties: The Envy Saga and Other Cautionary Tales in Singapore

.png)